Monese Bank Review and Guide: How good is the bank account for expats?

You have just arrived in Germany and you need to open a bank account in order to get your salary and pay your first bills? Maybe It’s your first time in Europe and you have only taken with you a small amount of money. Monese, a UK challenger bank, offers you a bank account which stands out for its speed, simplicity, and internationality.

Each account comes with a debit credit card and the ability to transfer money in over 19 currencies to countless countries. Whether it’s Bulgaria, Brazil, Romania or Switzerland, with a Monese account you can send funds all over the world in a few seconds.

Monese Bank, identified as a modern fintech, has over 2 million customers and aims to simplify, accelerate and economize the opening of a bank account and its usage.

Is Monese really making global local as it promotes? We tested Monese’s product and today we’ll show you step by step:

- How to open an account with Monese

- What services and benefits Monese Bank offers you

- What the costs are and what you should pay attention to

- What makes Monese definitely better than all other competitors

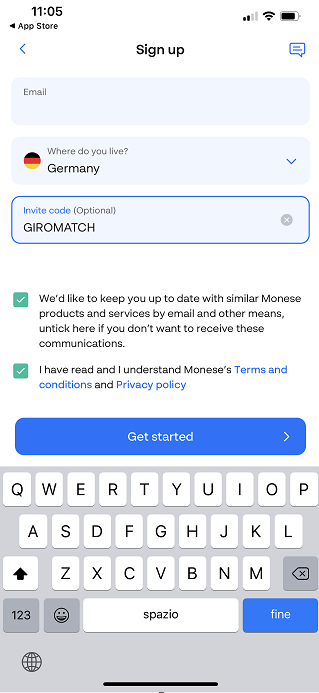

Use the code “GIROMATCH” to have an extra 10 EUR bonus in your Monese bank account at your first 10,- EUR payment!

Our Monese review at a glance

- Instant account opening in 3 minutes

- Free account with real-time transactions, debit card

- Instantly generate virtual credit card

- Support in 14 languages, incl. German, Turkish, Romanian, Polish and more

- No address verification or credit check

- International transactions in 19 different currencies

How did we test?

For our test, we open a Starter bank account with Monese. We compared its features with a traditional bank’s one and read carefully through its terms and conditions dated 28 September 2021. Our base of operations is Germany, therefore we focused on usage for Germans or Expats in Germany. However, Monese is a valid option for users across all Europe and beyond. The Monese app on Android (Google Play) was used. We analysed Monese’s data protection statements, pricing overview and regulatory fee information. We had a look at different customers’ reviews to assess its real suitability.

We cannot guarantee completeness and ask you to refer to the information on the Monese website yourself before purchasing the product, since its costs may change over time.

Pros and cons of Monese

Pros

- Instant account opening in 3 minutes, no credit history (SCHUFA) or address verification required.

- Free account with online payments and virtual card, only one-time 4,95 Euros for physical Debit Mastercard

- Immediately available virtual Mastercard card for mobile payments, online payments or cash withdrawals with contactless function

- 3 different account models available

- Support and app usage in 14 different languages

- possibility to send money in 20 different currencies from all over the world, free of charge to other Monese users. Currencies: AUD, GBP, CAD, CZK, DKK, EUR, HKD, HUF, INR, MXN, NOK, PHP, PLN, RON, SEK, TRY, USD, SGD, ZAR

Cons

- Delivery of physical debit card takes about 5 business days

- No free cash withdrawals in the free account version

- Fee-models are a bit complicated, making international remittances a bit more complex when it comes to calculating your actual cost

What account types does Monese offer?

Monese offers you 3 different account models to choose from. Each account type offers you more and more advantages, whereby you already get all important payment functions and a virtual credit card for free with the free account variant “Monese Starter“.

The other two models “Monese Classic” and “Monese Premium” cost 5,95 Euros per month and 14,95 Euros per month respectively and are suitable for you if you want to use the account more intensively. With the Classic account, for example, there are free cash withdrawals up to 900,- Euros and lower fees for international currency shipments. The Premium account is for absolute power users with 2.500,- Euro free cash withdrawals, free money transfer worldwide, premium service and an exclusive, free debit card.

All three variants are granted without checking your credit history. If you have just arrived in Germany or you still do not have a German residence, Monese bank account is a good option for you, since you don’t need to show your SCHUFA.

Monese’s 3 account models at a glance

Become a Power User with your Monese account

Send money abroad with Monese

Monese was created to make it easy to send money between different countries, whether in the EU, the UK or worldwide. This continues to be one of Monese’s special features as it offers you the app and account in 14 languages, supports 19 different currencies and that you can use from 31 different countries.

The fees for sending depend on your account model and are 2.5% for the free Starter and 0.5% for the Classic account. Transfers for Premium customers are free of charge.

What’s special: Transfers between Monese accounts are free! This means that you can invite your friends, family or acquaintances to receive the money. In return you will also get 50,- Euros credit on your account and you can invite up to 15 people.

These currencies are currently supported by Monese (as of May 2023):

Issue instant payments with the virtual credit card

Monese is the only account that allows the issuance and use of an instant digital credit card in our fintech and account tests. We got access to our own credit card number with CVV within 20 minutes and were able to add it to Google or Apple Pay immediately.

In addition, the top-up with a debit card works instantly, meaning the card can be loaded directly and used without delay. This works even on weekends or at night, so 24 hours, 7 days a week. In addition, with Monese brand new function “Split the Bill” you can now share your expenses with your friends.

To activate the card, you have to activate the virtual card in the app instead of the debit card. We will show you how this works:

Pay with your smartphone in supermarkets or retail stores

Monese account supports Mobile Wallets, which is why you can easily pay with your smartphone in retail or restaurant, or even withdraw money in a supermarket with cash payment feature.

You can add your debit card and your virtual card to your mobile wallet. To do this, you need the credit card number and you need to provide your address.

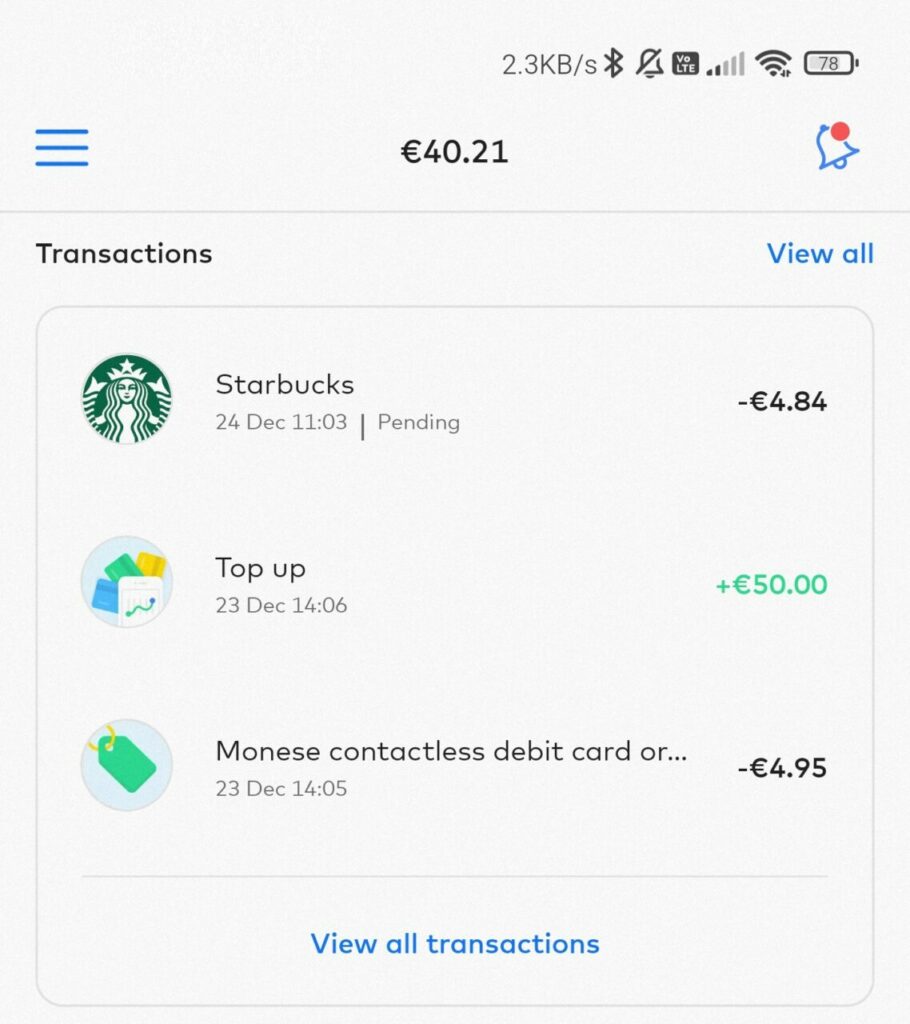

Here’s a payment in a Starbucks, less than 24 hours after we opened our Monese account:

Keep an eye on your income and expenses and save money

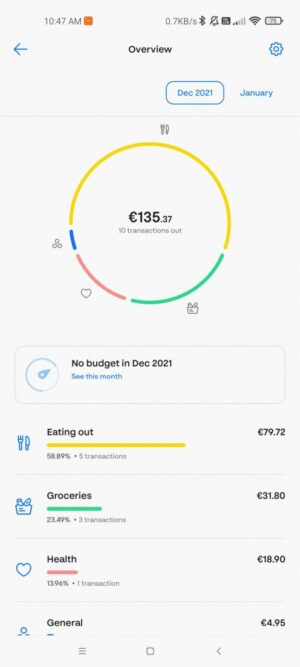

Monese offers you the possibility to organize your account inflows and outflows easily and clearly and to keep an eye on your budget. Monese automatically classifies your payments by different groups, for example for restaurants, bills, education or health.

You get a weekly and monthly overview of your expenses and income and you can set personal limits on how much money you want to spend.

Open a Monese account: How it works step by step

The Monese account is one of the easiest and fastest bank or checking accounts to open currently. This is because Monese has designed its account opening exactly for ease of use and opening.

We opened our account with a German passport on an Android smartphone. It only took us a total of 11 minutes for us to be able to use the account and deposit money into it. Within those 11 minutes, we installed the app, got identified with a passport, answered a few questions about ourselves, and selected our account model.

In return, we received a money account with a European IBAN, we ordered a debit card, we could create a virtual credit card, open a savings account and send the deposited money in 19 different currencies, paying (voluntarily, since the card is optional!) 4,95 Euros for sending the debit card.

In addition, GIROMATCH has an invite code for you! When opening a bank account with Monese, give the code “GIROMATCH” to get extra 10 EUR on your account balance (T&C here).

Open a Monese account: What you need

The following steps are necessary to open a Monese account.

- First you choose between a Euro account (EU or SEPA) or a Romanian account (RON). Currently, British accounts (GBP) are not possible due to the Brexit.

- Then you need to enter your mobile number, confirm your address and provide some personal information.

- Now you need an identification document. This can be either your personal ID, your passport or your registration confirmation. Next to the photo of your ID you have to take a selfie of yourself.

- Now follow some questions how you want to use the account, i.e. how active you will be, if you want to send funds abroad and how often you will recharge it. You also need to specify where the money you will deposit into the account will come from.

That’s it! Your confirmation will be sent immediately if all the information is correct. Now you can choose your plan and deposit money directly.

Monese bank account: Review in detail

Out of all our tests of fintechs, checking accounts, and banks, Monese absolutely delivered on speed and simplicity. User friendly, straightforward, no big words or paper.

We opened our account within 10 minutes and were able to use it right away – including deposits, a working IBAN, a virtual card, savings function and much more.

The physical debit card still needs a few days, but thanks to contactless, the account is already fully operational with our smartphone even now.

We are impressed and award 5 out of 5 points for speed.

The cards are a debit card and an electronic card. Both are credit cards, but you don’t get credit in the first place, they can only be used for payments.

The euro account is held at a Belgian bank or a Belgian e-money institution, which is why you “only” get a Belgian IBAN. However, this should not cause you any problems, as banks must accept all IBANs for payments, regardless of the country.

The possibility to send funds in countless currencies is a huge plus and makes Monese attractive not only for expats, immigrants or foreign students. Because it also makes it possible to prepare for travel and send funds to acquaintances and family abroad within seconds – whether in Bulgaria, Poland, Switzerland or Australia.

3 simple account models with one free. The Starter account is free and you have all the features at your disposal. You only pay if you use them, e.g. for payments in foreign currency.

With the Starter, Classic and Premium packages you can freely choose what suits you best and start at 0,- Euro up to a maximum of 14,95 Euro per month.

From our side a very solid offer, which can also be upgraded or downgraded monthly.

Monese’s service is available in 14 languages and is available via phone, chat or email. In general, the app is set up in such a way that you rarely need the service and it is all self-explanatory.

We only gave Monese 4 out of 5 stars because the phone service wasn’t always available for urgent issues and you’re only sure to get immediate feedback on your problems with the premium version. For other issues, it takes up to 48 hours for feedback.

The supported languages at Monese are currently (January 2022):

- Bulgarian

- Czech language

- German

- Estonian

- English

- Spanish

- French

- Italian

- Lithuania

- Polish

- Portuguese (PT/BR)

- Romanian

- Turkish

What’s behind Monese?

Although Monese offers something like a full bank account, it is not legally a bank at all, but a fintech, or financial technology company. Monese is based in the UK, more specifically at 1 King Street, London EC2V 8AU. Legally, Monese is an e-money institution (“E-Money Institute”) and works with Belgian provider PPS EU S.A. (PrePay Solutions S.A.), which supplies the Belgian (and other) IBANand has licenses for the UK.

Monese currently has around 300 to 400 employees and has 2 offices in the UK and Estonia. Due to the large growth, another €80 million in investor funding was raised most recently at the end of 2021 to allow the fintech to grow further. We currently estimate the customer base to be just over 2 million.

As follows the most important contact information about Monese:

| Company name | Monese Ltd. |

| Company type | Fintech |

| Address | 1 King Street, London EC2V 8AU, United Kingdom |

| Website | monese.com |

| support@monese.com | |

| Phone | Not available |

| Not available | |

| Hours | 24/7 |

| Social Media |

Instagram |

| English support | No |

FAQs about Monese: Everything that you need to know

Monese is a British company that offers you a mobile money account. Monese is not strictly speaking a bank, but a payment institution that gives you access to financial services in Euro countries, the UK and Romania.

When you open an account, you will have almost all the functions that you will know from a normal current account, such as making payments, direct debits, sending funds at home and abroad, and much more.

No, Monese does not work with SCHUFA. When you open an account, the SCHUFA is not queried or data is shared with the credit agency.

You can open an account even if you have a negative SCHUFA or a negative entry.

Furthermore, unlike an account from a German bank, your Monese account will not be reported to the SCHUFA or any other credit agency.

The account in the “Starter Pack” is free of charge, you only have to pay for transactions such as foreign transfers or cash withdrawals. Cash withdrawals cost 1.95 euros per transaction and the one-time shipping of the card costs 4.95 euros.

The “Classic” account model costs 4.95 euros per month, while the “Premium” account costs 14.95 euros per month. Here, both the limits for free cash withdrawals and deposits are much higher, and the fees for international transfers are lower or, in some cases, completely free.

Yes, Monese is a UK company whose licensors are supervised by the UK Financial Conduct Authority (FCA) and the National Bank of Belgium respectively. Monese is now over 5 years old, has over 2 million customers and has raised over 150 million euros in investor funds to facilitate banking across the European region.

Monese is available in the following countries:

- Austria

- Belgium

- Bulgaria

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Great Britain

- Iceland

- Ireland

- Italy

- Croatia

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Malta

- Norway

- Netherlands

- Poland

- Portugal

- Romania

- Slovenia

- Slovakia

- Spain

- Czech Republic

- Sweden

- Hungary

Yes, you can link your PayPal account directly to Monese and vice versa. This means that you can use your Monese debit card to make payments in your PayPal account, e.g. to pay a PayPal installment.

In addition to PayPal, Google Pay is also supported, which allows you to make payments in stores or supermarkets.

The BIC is PESOBEB1. This is the identification code for PREPAYMENT SOLUTIONS EU S.A., the licensor for Monese in the European Economic Area.

Your IBAN generally starts with “BE*” and has only 16 digits, in contrast to a German IBAN which starts with “DE*” and has 22 digits. Since 2023, Monese also supports Multi-IBAN.

You can find the bank code when you click on “Details” in your Monese app in the account on the home page, directly under your account balance.

You can easily close your Monese account in the app.

- Open your Monese app and go to your Profile

- Tap on Settings and Account Settings

- Select Close account and follow further insrtuctions.

Alternatively you can close your account by sending an email to closures@monese.com but be sure to send it from the email you gave when applying for the account.

Hi, can you please tell me if I can send money cash pick up transfers. And also if they also send the card outside of Europe if one is travelling overseas for 1 or 2 years but still residing in the European Union?

Hi Sasha,

we have not asked for the card to be dispatched abroad, so we cannot say for sure, but we assume that only EU addresses or rather addresses in the countries that Monese is available in can be used.

A workaround might be to use a mail forwarding service that receives and forwards your mail to your new address.

Update as of June 1, 2023: We have added the latest conditions to the review:

– The recharge fee in the Simple plan has been increased from 0.3% to 1.0%.

– Incoming transfers from abroad will now be processed with a transaction fee (2% for Simple, 1.5% for Classic and Premium).

– We’ve updated the accepted currencies. Currently Turkish Lira and Swiss Francs are not supported