Miles and More Gold Credit Card: Experiences and Review

The Lufthansa Miles and More Credit Card is the Germany’s largest credit card program for frequent flyers, travelers, and as a status symbol. If you’re looking to consistently boost your Lufthansa Miles & More account, then the Miles and More is an absolute must. Welcome bonuses, earning miles with every card usage, and attractive options to convert and spend miles – all of this is offered by the Miles and More Gold Credit Card.

There are two main variants of the Miles & More Credit Card: the Miles and More Blue Credit Card and the Miles and More Gold Credit Card. Both models are available for individuals as well as self-employed individuals, freelancers, and businesses (“Miles and More Business Credit Cards”). Both are charge cards, granting you a monthly credit limit. The two cards also differ in terms of benefits, options, and fees.

We applied for the Miles and More Gold and we’ve been using the card for over a year now. In our Miles & More review, we’ll show you how good the Miles & More Credit Card really is, its pros and cons, what to consider with the credit card, and how to use it in everyday life.

Our experience with the Miles and More Gold Credit Card

Blue, Gold, Status Cards: These Card Variants Are Available

The credit card we are evaluating here is the Gold variant. Lufthansa or Miles & More offers various versions with different costs and benefits. Starting from August 1, 2023, new conditions apply to Miles & More Blue and Gold credit cards, with prices increased on average by 20%:

- Miles & More Blue Credit Card: €5.50 per month (previously €4.58 per month)

- Miles & More Gold Credit Card: €11.50 per month (previously €9.16 per month)

- Lufthansa Frequent Traveller Credit Card – Status card (€5.41 per month)

- Lufthansa Senator Credit Card – Status card (free of charge)

- Lufthansa HON Circle Credit Card – Status card (free of charge)

Each of these cards is available for both private individuals and business customers (Business) and earns miles with each transaction. The main differences between the cards are the premium features you receive with the higher tiers.

It’s worth mentioning that the Blue and Gold cards can be easily ordered online, while the Frequent Traveller, Senator, and HON Circle credit cards are exclusive and accessible only based on status. This means specific flight behavior and existing flight miles are prerequisites. For instance, the Frequent Traveller requires 30 flights per year or at least 35,000 status miles per year.

Pros and Cons of the Miles & More Credit Card

Vorteile

- Up to 15,000 bonus miles as a welcome bonus

- Earn 1 mile for every 2 euros spent with the card

- Unlimited mile protection (miles do not expire)

- Premium insurance services, such as trip cancellation and interruption insurance, rental car coverage, or overseas travel medical insurance.

- Additional mile discounts and promotions at selected shops

- Avis Preferred status for car rentals

- Convert miles to money with MilesPay (currently: convert 3,200 miles for €10) Exchange bonus miles for status miles (e.g., for airport lounge access)

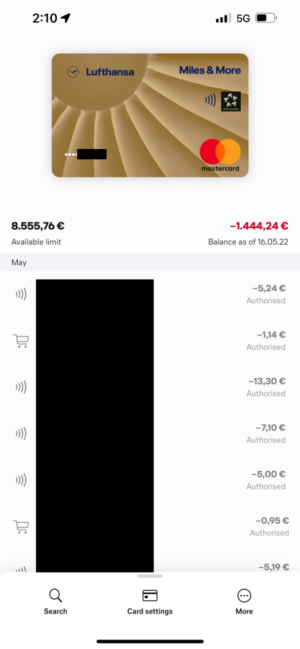

- High credit limit (in our test, an immediate €10,000 limit)

- First two cash withdrawals abroad are free each year

Nachteile

- €11.50 per month or €138.00 annual fee (Gold Card, from August 2023)

- Foreign currency fee of 1.95% of the transaction amount

- Cash withdrawals at ATMs cost 2% of the transaction amount starting from the third withdrawal (minimum €5)

- Additional card (partner card) comes with a fee: €5.83 per month or €69.96 per year

- Switching from monthly billing to partial payment option requires a new application

- Interest rate for partial payment function is 8.90% effective annual rate

- Card issuance and delivery took 7 business days

- PIN cannot be changed

- System transition: Miles & More is switching from DKB to Deutsche Bank, planned for 2025. Significant changes are unlikely until then

🔒 Secure and encrypted

Advantages of the Miles & More Gold Credit Card

Miles and More is part of the Lufthansa frequent flyer and rewards program. Therefore, the Lufthansa Credit Card offers specific advantages for travelers, frequent flyers, and globe-trotters. You accumulate miles, receive travel protection, and have access to special services 24/7, with Miles & More offering phone support.

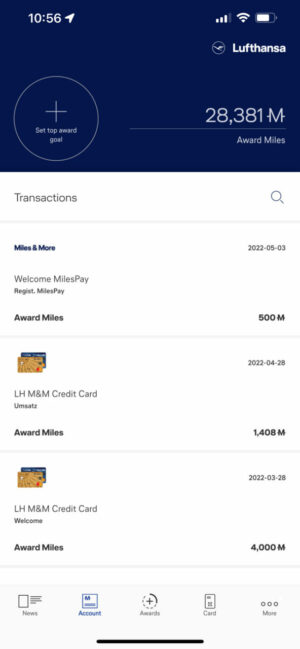

In the Gold variant, in addition to the generous welcome package of up to 15,000 bonus miles, you also have the opportunity to earn 1 bonus mile for every €2 spent. Currently, Economy flights to London, Paris, or Madrid start at around 15,000 miles – meaning that with the credit card, you’re already gifted a significant portion of the flight. A flight to Chicago or Dubai, for example, starts at around 30,000 miles. Current flights and bonus offers available for redeeming miles can be found on the Miles & More Mile Bargains page.

As a Gold Card holder, you also enjoy special conditions for shopping in numerous stores. Electronics at Dell and Media Markt, fashion at H&M, Peter Hahn, or Puma, or energy contracts with EnBW and newspaper subscriptions with Die Welt or FAZ: The Miles & More Credit Card is the “hub for your shopping experiences,” providing discounted offers or additional miles.

Are the Miles & More Card Mile Offers Worth It?

Honestly, we have never actually used the discount feature after all this time. The benefits and discounts are usually given as a percentage of spending, so you always have to spend money. Bonus miles are quite modest, and instead of getting 1 mile per €2, you might get something like 1 mile per €1 for the first few hundred euros.

Few exceptions that allow you to accumulate thousands of miles at once are the investment offers. Currently, there are offers with Allianz Global Investors or asset manager LIQID. Investments in ETFs or similar are rewarded with up to 150,000 miles (provided you maintain the investment for a certain period). So, if you’re considering investing a substantial amount of money, you can directly boost your miles account or secure a frequent flyer status with an investment of €175,000 in ETFs (175,000 bonus miles can be exchanged for 35,000 status miles, granting you the Frequent Traveller status).

Paying with the Miles & More Card, Credit Limit, and Partial Payment Function

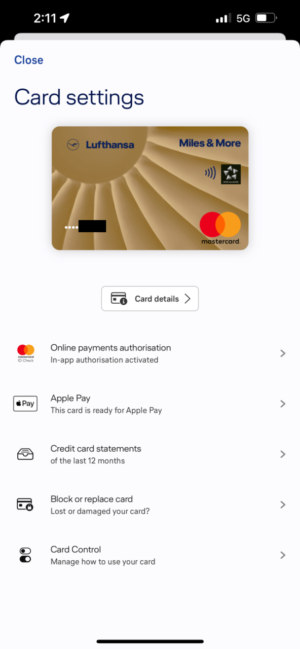

The Lufthansa Credit Card offers all the features you need. The stylish Mastercard Gold card is naturally a status symbol and can be used for contactless shopping. With mobile wallet features, you can conveniently add it to your iPhone or Android phone and use it for online payments. Through the Card Control feature in the app, you can decide whether to enable online payments or not. With country control and spending limits, you also have added protection. Of course, the hotline for card blocking is available 24/7.

The Miles & More credit card is also a charge card, meaning you receive a monthly bill and have up to 30 days to settle your expenses. This provides you with a flexible credit limit, especially useful during travels. In our Miles and More credit card test, our credit limit was €10,000.

When you log into your Miles & More card account, you have the option to activate the partial payment function. With this, you can pay off your credit limit over several months and transform the card into a revolving credit card. You need to repay at least 10% of the outstanding credit amount per month. You will then pay 8.90% effective annual rate on the used credit limit as interest.

Drawbacks of the Miles & More Gold Card

Quality comes at a price. That’s also the case with Miles & More. All the advantages of the gold credit card come with a monthly fee of €11.50 (previously €9.16). You can also pay the fee in miles, which would cost you 3,450 miles (previously 2,750 miles) per month. Annually, this amounts to €138.00 in fees or 41,400 bonus miles that you need to redeem (equivalent to €80,000 in annual spending!).

In addition to the annual fee, there are fees for payments in foreign currencies (foreign currency fee). This fee amounts to 1.95% of the transaction value for each card usage. Also, 2% of the transaction value (minimum of €5) is charged for cash withdrawals at ATMs. In August 2023, the conditions were slightly improved, and Gold Card holders can now withdraw money abroad for free twice a year – a nice new advantage that makes the card more of a travel credit card. Additionally, the new Flexiroam function allows cardholders to receive 1 GB of free data volume for mobile surfing abroad three times a year.

Both of these are good, new features, yet despite being positioned as a travel card for frequent flyers, it’s not necessarily ideal for use abroad – especially not if you make regular cash withdrawals in foreign currencies.

If you not only want to use the Miles & More as a charge card with a monthly payment deadline but want to convert it into a true credit card with a partial payment function, you need to apply separately with DKB (the bank behind Miles & More). The effective interest rates amount to 8.90% effective annual rate on the outstanding credit amount. The monthly minimum partial payment amounts are relatively flexible at 10%, 20%, or 30% of the outstanding credit amount.

One small issue that applies to all banks in Germany: The monthly Miles & More credit card statement is not available via email. While DKB does send me a monthly email, neither is the statement attached (yes, data privacy…) nor does it contain a link that takes me directly to the correct portal or app location. Additionally, my Miles & More app only shows me statements from the previous year – even though it’s currently April. For current statements, I always have to go to the Miles & More online banking through a browser.

Miles & More is switching to Deutsche Bank – What to Expect?

In July 2023, Lufthansa, Deutsche Bank, and Miles & More announced that starting mid-2025, the credit card will be issued by Deutsche Bank instead of DKB. This is a significant change for the 1993-introduced Lufthansa loyalty program. Although there have been changes before – initially, LBBW distributed Miles & More with VISA before it switched to DKB in 2006 – this announcement is significant because Deutsche Bank is not really known for its co-branding in the credit card business.

For us as customers, this likely means that there won’t be major changes until the switch planned for 2025. Until then, we’ll probably have to wait and hope that the move to Deutsche Bank will bring some new interesting benefits.

Alternatives to the Miles & More Gold Card

Although the Lufthansa card generally makes a good impression, it doesn’t offer all the features one seeks in a credit card. The Miles and More Blue Card, while cheaper than the Gold Card, comes with fewer features. We generally recommend some alternatives based on different use cases.

Free Travel Credit Cards (especially without foreign currency fees, no cash withdrawal charges)

For those who travel a lot and want to avoid fees, especially abroad, they should consider the Advanzia and Consors Finanz Mastercards. Both cards have no foreign currency fees and allow free cash withdrawals abroad. Another alternative is the card duo from Barclays, where both a VISA and a Mastercard are issued. While they offer free withdrawals and payments in foreign currencies, they come with an annual fee of 99 euros.

My solution is the DKB account, which I use as my primary account. With the DKB debit card, traveling is hassle-free, and there are no unnecessary fees. Bonus for the Miles and More: This is displayed directly in DKB online banking, and I can reconcile all transactions in one place.

Credit Cards with Bonus Offers, for Collecting Rewards and as Status Symbols

For those seeking a credit card for luxury, bonus offers, and rewards, they should definitely look into the American Express Platinum card. American Express is the ultimate credit card when it comes to lifestyle, status, and luxury, and the black version is available only for millionaires and VIPs.

Alternatively, for those who prefer to do something good for the environment for a bit less money, they should consider the sustainable credit card from awa7. This revolving credit card is free and plants trees for every euro spent.

Miles & More Business, Frequent Traveler, Senator, and HON Circle Member Cards

In our test, we focused on the Miles and More Gold Card for individuals. However, all Lufthansa cards are also available in the business version for freelancers, self-employed individuals, and small businesses.

Additionally, there are three more exclusive Miles and More cards:

- The silver Frequent Traveler card,

- the Senator card,

- and the exclusive HON Circle Member card.

As a Frequent Traveler, you get free lounge access; as a Senator, you can also bring extra luggage and benefit from more opportunities to collect miles. With the HON Circle Member card, for which you need 600,000 HON Circle Miles (only Business or First Class), you are treated like royalty by Lufthansa and the Star Alliance.

Fees, Costs, Limits, and Interest Rates for the Miles and More Gold Credit Card

Contact, Service, and Hotline for the Lufthansa Miles and More Credit Card

Your primary point of contact is the Lufthansa Card department, which handles most issues.

However, behind the credit card is actually Deutsche Kreditbank AG, the DKB, which manages the credit card accounts, provides online banking, and is often available for inquiries about deductions, card statements, and payment flows.

Here’s how you can reach Miles & More support via email, phone, or mail:

Frequently Asked Questions about the Miles and More Gold Credit Card

The Lufthansa Miles and More Credit Card is especially suitable for individuals who have a high card turnover domestically or in Euro countries and want to collect miles. For every 2 euros you spend, you get 1 euro – with special packages, you can even get 1 mile per euro.

However, if you think the Miles and More card is suitable for travel, you’re mistaken. The high foreign currency fees and costs abroad make the card relatively unattractive. Here, we recommend opting for a free travel credit card, while it’s best to leave the Lufthansa card at home.

The outstanding credit amount is debited monthly from your reference account via direct debit with the Lufthansa card. If your credit limit is not sufficient and you would like to transfer more money to the Miles and More card account, you need to transfer the money to the following account, specifying your 15-digit Miles & More service card number:

Recipient: Lufthansa Miles & More Credit Card IBAN: DE64120300000029995552 Bank: Deutsche Kreditbank AG Reference: Your 15-digit Miles and More service card number and the name of the cardholder

If you want to read the instructions directly from Lufthansa, you can find the detailed explanation of how to deposit money into your Miles & More credit card here.

You can find the login for your card account, credit card statements, and current mileage promotions on the page https://www.miles-and-more.kartenabrechnung.de

The miles are credited approximately 2 days after the statement, which always takes place on the 28th of each month. So, by the 1st of the new month, you should receive all the miles you earned in the previous month through card transactions.

Note: Miles and More rounds down your payment amounts, so for example, 3.90 euros in turnover will only yield 1 reward mile.

Miles and More has deals with almost every car rental provider. With Hotels&Cars by Points, you can either spend miles to get a rental car or earn extra reward miles with a rental car.

Deals are available with at least Europcar, Sixt, Avis (with the Gold Card, you get Avis Preferred Status), and Budget.

You can book rental cars with miles on the Miles and More Points page.