Credit cards in Germany: Tips and recommendations

Credit cards in Germany have become more and more popular over the last years and having a good credit card is important for anyone coming to Germany, whether it’s for travel, for business or to live here. But getting your own card is not as easy as it looks. Picking the right type of credit card (credit, debit, charge, virtual?), navigating the over 2.500 German banks and figuring out what they really cost can be tough.

To find the best credit card that suits your needs, we will show you what you need to pay attention to, which type of credit card makes sense for you and we’ll show you quite some facts about credit card usage in Germany. We also have several choices depending on what you need and have in-depth reviews of the providers.

We’re generally focussing on foreigners who are just coming to Germany or who have been here for a while, but who might not be able to speak German yet. We thus focus on cards that make sense for foreigners such as students, expats or immigrants.

Credit Card Germany: An overview and how we evaluated them

There are several different things we considered in our evaluation and want to tell you about our process.

We have tested the credit cards regarding their ease of application process and availability for foreigners (students, expats, immigrants) living or coming to Germany. For this reason, we have included information on requirements in regards to income, residency or credit history. We have also included English-speaking support and app as a feature as well as the time it takes for you to receive your card.

We evaluated the types of cards in regards to their features and costs. There are free credit cards (usually revolving credit cards with an APR), as well as prepaid credit cards and bank acounts that provide free debit cards for those who just want a means of payment or for cash withdrawals. Remember that costs are different for the types of cards – revolving cards are often free, but charge high interest.

We looked at features and services that the credit card provides. This includes traditional factors such as payment methods, free ATM withdrawals in Germany and abroad and of course travel insurance offerings. We have also for the first time included sustainability as factor, such as trees planted for card revenue or possibility to offset your CO2 footprint.

Comparison of different German credit cards

The following 5 credit cards are good options for you to choose from. With the exception of awa7, they all offer English-speaking application processes as well as English level support and apps. We’ve also included 100% free cards and accounts such as Vivid Money (read our Vivid Money review), which does not require and income verification or credit history – thus giving you a very good choice if you want a low risk card where chances are very high that you will accepted.

The Advanzia no fee Mastercard (here our in-depth review) and the sustainable awa7 credit card (awa7 Review here) are both options that make sense if you’re established in Germany and have a credit history, as both revolving cards will give you a credit limit that can range anywhere between 100,- Euro up to around 25.000,- Euro for the Advanzia.

VIABUY is a quick option if you need a prepaid card with no questions asked, that you will receive within 24 hours after application.

We have finally included Tomorrow Bank (read our Tomorrow review here) as an intermediary between a working credit card that is cheap and offers useful features, English speaking support and a focus on sustainability. Tomorrow only comes with a current account though, so you will open a bank account with a German bank number (IBAN) as well.

We previously (until November 2021) picked the DKB-VISA as the best credit card in Germany because it was free and came with an overdraft of up to 500,- Euro automatically. However DKB has changed their cost- and credit card model, so now you only get a free debit card and will need to pay 2,95 Euro per month for the VISA credit card. You can read our in-depth review of DKB if you have further questions (in German). The bank account with the debit- and the new credit card are still valid, so it might be worth having a look.

Best credit card in Germany: Further options with more details

Best free credit card with credit limit: Advanzia Bank

We’ve chosen Advanzia bank as your best option because we know from our own experience that Advanzia is a revolving credit card that you can get even if you have no credit history in Germany (“SCHUFA”). Many banks will decline to give you credit if your credit history is empty. This is particularly an issue if you have no banking history in Germany. The expected credit limit for an initial application should be around 500,- to 1000,- Euro, but is dependent on your income and can be expanded later.

Best prepaid credit card: bunq

- Open a Checking Account in 5 Minutes with a MasterCard

- Includes a Maestro card, 25 online cards, and the option to open sub-accounts.

- No credit check required for opening.

- Mobile bank with a top app, Google Pay, Apple Pay, and web access.

- Sustainable and environmentally conscious banking.

- Currently offering 3.36% interest on the account with MassInterest.

Once again, we went with a bank account that offers you several types of credit cards, including a debit credit card that functions as a prepaid card. bunq is not a free account as the “Easy Bank”-Model will set you back 2,99 Euro per month with one card. If you opt for the “Easy Money” model, you’ll pay 8,99 Euro per month but you will have 3 credit card: The Maestro card, the Mastercard debit card and, if you want, the Mastercard Metal Credit Card. What makes the bunq an ideal prepaid credit card is the ease and speed with which you can open your account.

You can find our in-depth review of bunq here.

Best virtual credit card: Extra

With its brand new Extra Card, the Maltese Novum Bank offers a competitive virtual (and physical) revolving credit card with a credit limit up to 3.000,- Euros. In order to get a conspicuos credit limit, you should have an income of at least 1.000,- Euros and a good credit history. Even though the conditions are not the best, the card is immediately available upon application and can be used straight away. To date (September 2022) no English application process and customer services are available.

How you can get a credit card in Germany

There are three basic steps to get a credit card in Germany. The good news is: you don’t have to walk into a bank to get one. You can do it online as well. The three steps are:

- Application

- Identification

- Issuing

1. Applying for a credit card

For application, all financial services providers are required to collect basic information from you. These will generally include:

- First and last name

- Your current address (in the EU or Germany is required)

- Birth date and birth place

- Nationality

- Email and Mobile Phone number (for verification purposes and contract information)

If you are applying for a credit card with a credit limit, you will almost certainly need to add information on your job, your net income as well as existing credit expenses. All traditional banks and online banks will also ask you for a “SCHUFA allowance”, which means they will check your credit history. SCHUFA is by far the largest credit agency in Germany that is used by almost all the banks. If you would not like to have your credit history checked, you should apply with a neobank like bunq or Vivid Money.

2. Identification process

It is legally required to identify every person that applies for a bank account or a credit card. This is usually a quick video call with a customer service agent who verifies your person and data. You will need a valid identification document for this process, such as a passport or your national identification document. This identification is also free for you.

Some of the older providers or traditional banks also make it possible for you to identify yourself in person in a local bank branch or through what is called Post-Ident, which is a piece of paper with which you can identify yourself with in a local post office of the Deutsche Post. Bring your ID or passport as well and the person in the post office will guide you through the process.

3. Issuing and dispatch of your credit card

The final step is issuing, which basically means the time between finalizing your identification and the bank providing you with your card. For neobanks or virtual credit cards, this should only take a few minutes and you will have access to your virtual credit card with your IBAN right away. Generally they send you an email with the access and you can login to see your credit card number. If you have Google Pay or Apple Pay, you can also use the card in stores with contactless payments and won’t have to wait for the card to arrive – another plus for mobile banks.

The physical card will be sent to your address in a matter of days. If you’re in the EU, it might take a bit more time for the card to arrive and it will also work with banks who have the same product in different countries. Please note that some providers don’t send cards in all the countries and you will need a German address.

What are the requirements to get a German credit card?

- You have to be 18 years or older

- Your permanent residence has to be either in Germany or the EU. If not, you will need a registration document for Germany (Meldebescheinigung or Anmeldebestätigung/Anmeldung)

- You need a valid identification document (passport, national identification document for EU citizens)

- For online banks, you will need a mobile phone number and a valid Email

German credit cards: Understand who to choose from

Before you choose a credit card or a bank account, you should know how the market works, so you can better understand what features to expect – and what not to expect. The German banking market can be structure into three types.

| Traditional Banks | Online Banks | Neobanks |

|  |  |

| Deutsche Bank Commerzbank Sparkasse Volksbanken | DKB ING comdirect Hanseatic | N26 bunq revolut Vivid Money |

Traditional banks: Deutsche Bank, Sparkasse, Volksbanken

“Traditional banks” which can be public or private banks like Sparkasse (Savings Banks), Volksbanken but also large houses like Commerzbank and Deutsche Bank. These offer all the services a bank can offer, will have a large, albeit decreasing number of physical branches and are usually not the cheapest options.

Direct banks and credit card banks: ING, DKB, comdirect

The second branch are Direct Banks or Online Banks (“Direktbanken”) which have no physical branches but operate only online. They have a large variety of services and have changed the German banking market between the years 2000 to 2020 heavily. You will find speciality providers for credit cards like Advanzia Bank or Hanseatic Bank, providers that have everything like ING or DKB, or loan and financing banks like SWK Bank.

Neobanks and smartphone banks: N26, bunq, revolut, Vivid

The third type are so called Neobanks or Smartphone banks, sometimes also called “fintechs” for financial technology. These are smart, lightweight banks that offer “boutique” services through their app or online. Most offer “freemium” models, where all the basic financial and credit card services are free, but for small monthly fees you can increase the power of your credit card and account. Another advantage: These banks are usually international, have English-speaking support and services and are operational not just in Germany, but many countries in the EU

Credit card usage in Germany: What you need to know

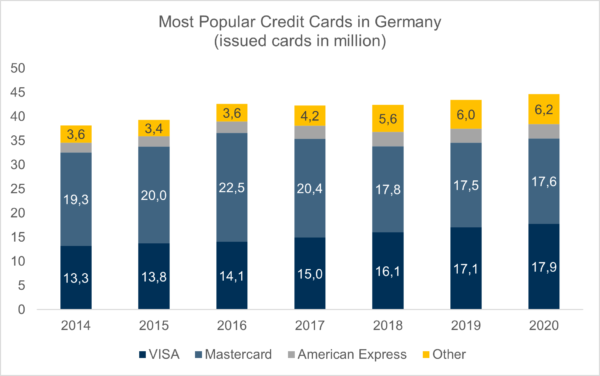

Germans love their cash. When not using cash, they still have their own card-payment-system that has historically dominated non-cash payments. But things have changed in the last years. VISA and Mastercard are more and more common. Cashless and contactless payments using cards or NFC (near-field-communication) have been on the rise and increased year-on-year during Covid.

From the traditional banks like Sparkasse, large credit institutions like Deutsche Bank or Commerzbank and especially the up-and-coming smartphone banks hitting the German market, everyone is offering a credit card from VISA or Mastercard when opening an account. Those credit cards are oftentimes debit cards or charge cards using the payment networks of the large credit card providers.

Credit card usage: Numbers and where you can pay

Currently, there are around 40 million credit cards and 115 million debit cards in circulation in Germany (Bundesbank). VISA and Mastercard are by far the largest, with around 18 million cards each (Statista) and are well accepted in stores and the supermarket, online as well as on all ATM networks in Germany. If you have an American Express, Diners Club or JCB credit card, you will find that the acceptance rate is quite a bit lower.

With the introduction of contactless payments through NFC, many shops and stores have updated their payment infrastructure, so you can now usually pay with a credit card just by holding it against the terminal. In some more rural areas you should probably carry some cash as a fallback, and when you get a taxi ride in Germany, ask if the driver accepts credit cards.

Fees, costs and interest rates for German credit cards

Generally, the fee structure and costs will vary differently, depending on the type of credit card you choose. For revolving credit cards with a credit limit, such as the Advanzia, the Hanseatic or the Awa7, you will mostly pay high interest on your credit limit (usually around 16 – 20% APR).

Debit credit cards or charge chards come with a current or bank account that might incur fees, or there could be some limits to the amount of free cash withdrawals (in Germany or worldwide) from an ATM after which you will pay for each time you withdraw cash.

For prepaid credit cards, there could be an activation fee, a yearly fee or a charge-up fee when you wire money onto the account. This is similar for virtual credit cards.

| Type of credit card | Type of fee to look out for | Examples of providers and banks |

| Revolving credit card (Credit card with credit limit) | Interest Rate, cash withdrawals (EU/worldwide) | Advanzia, Hanseatic, Awa7, Extra Card |

| Debit card or charge card (no limit) | Fees of bank account that’s entailed, cash withdrawals, | DKB, ING, comdirect |

| Prepaid credit card | Yearly fee, top-up fee | VIABUY, Black&White |

| Virtual credit card | Yearly fee, top-up fee, interest rates | kredu, bunq |

Frequently asked questions regarding credit cards in Germany

Generally, VISA and Mastercard have the highest acceptance rate at stores and make up around 80% to 90% of all credit cards issued in Germany. American Express and JCB networks will be a bit more difficult, but are accepted at large restaurants and hotels.

Bring a VISA or Mastercard with you and

If you want a revolving card, you should opt for the Advanzia no-fee credit card. If you don’t care about the limit but just want a good credit card for payments, consider a coupled bank account such as Tomorrow, Vivid or bunq.

We have plenty of in-depth reviews of fintechs, banks and credit card providers in our review-section where we test and review the products, so you might want to take a few moments and read some of our guides.

The best free credit card that allows you to do everything you need, from payments to transactions, is the free account of Vivid Money.

Previously, DKB and Tomorrow Bank offered free accounts, but both have changed their account models and both cost now around 3,- Euro monthly.

In large cities, generally yes. But you should always ask the driver first for two reasons: 1) Some don’t accept credit cards (only debit) and 2) even if they accept credit cards on their payment terminal, some might not want to due to the fees a credit card transactions incurs. It is easier to carry some cash or use services as Uber or FreeNow to book and pay a taxi online in advance.

Travel insurance is not always included and is generally subject to the cards or the issuer you have chosen. Benefits could include travel insurance, purchase protection, cashbacks or collecting miles. Purchase protection is generally available and service quality – also for emergencies – is at a high standard in Germany. When it comes to speciality benefits like hotel discounts or auto rentals, you have to go with specific premium credit cards such as an American Express or a Miles & More Gold.

If you have a credit card with an online bank or smartphone bank, you can generally cancel your credit card by sending an email from your account to the customer service of the bank.

Some providers might require you to send a letter or fax with your name, credit card number (or IBAN) for identification and your signature.

First of all, only a few amount of credit cards will charge you an interest rate, because only revolving credit cards and credit cards with a limit grant you actual credit. Most cards are just debit, prepaid or virtual cards with no limit.

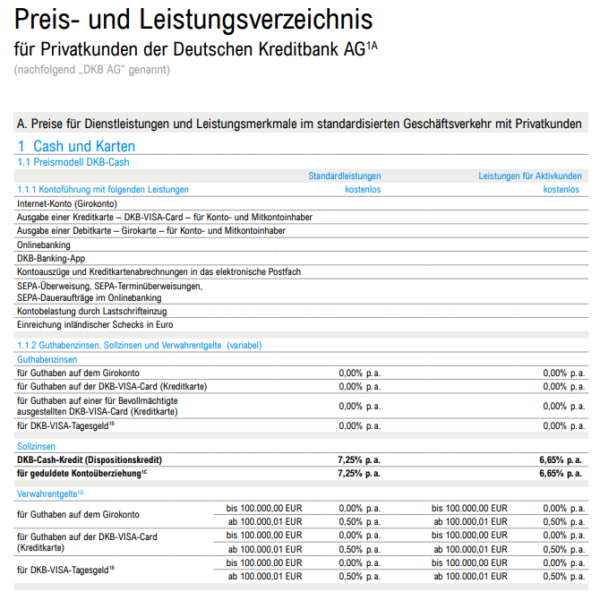

If you want to find out your interest rate, you can check the pricing table from your bank. This can be found under „Preis- und Leistungsverzeichnis“, or maybe „Preisübersicht“, „Preistabelle“, „Kostenübersicht“ or similar keywords. Banks cannot hide the interest rate from you.

You should expect an interest rate (APR) at around 13% to 20% per year.

Yes, using your credit card is safe for online purchases.

For larger purchases, VISA and Mastercard have also implemented security measures such as Verified by VISA as well as Mastercard Securecode. With banks such as bunq or DKB, you can also set payment alerts or block transactions unless explicitly granted on our smartphone to make sure your payments are secure.

Did you find this page useful and want to leave a feedback? Have you already applied for a credit card in Germany and want to share your experience with us? Leave a comment, we look forward to reading your opinions!

I’m not sure where you’re getting your information, but great topic. I needs to spend some time learning more or understanding more.

Thanks for fantastic information I was looking for this info for my mission.

Exelent services

so cool

how can i get visa card

i don’t know

What android app can be installed to show account full details on Cards

How can u get full details on cards?

I need a credit card number which is working all over the world

I am not sure where you’re getting your information, but good topic. I needs to spend some time learning much more or understanding more.

Thanks for great info I was looking for this info for my mission.

Thanks for great information I was looking for this information for my mission.

I needs to spend some time learning much more or understanding more.

stay away from Advancia, it is not worth 22.89%Pa, instead ask your bank for overdraft which would be half the interest rate

I’m still trying to find a card I tried to apply but it didn’t go through

Nice